A life Insurance policy offers guaranteed financial protection to the nominee in the event of the unfortunate demise of the life assured.

It may also provide you with a financial backup in case of an accident or any other event which may cause temporary or permanent disability and therefore loss of income.

Life insurance can also help as a saving or investment tool. One can use the saving and investment plans to save for specific-financial goals.

Future Generali offers different kinds of simple-to-understand life insurance policies. These plans will help meet your various needs such as protection, savings, investments, child’s education, health etc.

| Life Insurance Plans | Coverage |

|---|---|

| Term Plans | Pure risk cover (only death benefit) |

| Traditional Endowment Plans | Insurance Cover + Savings (death benefit + maturity benefit) |

| Money Back Plans | Insurance cover with periodic returns |

| Whole Life Insurance Plans | Coverage for a lifetime |

| Child Plans | To create a corpus for child's education + waiver of premium (in case of death of parents) |

| Retirement Plans | Life Cover + Regular Income for an independent and worry-free retirement |

| ULIPs | Insurance + Wealth Creation (market linked returns) |

Term insurance is the most basic form of life coverage. It is a "pure risk cover". While the policy is active, it pays life cover amount to the nominee in the case of demise of the life assured. Some term insurance policies also allow the life assured to select how the benefit should be paid to the nominee. Some of the prevalent pay-out methods are:

A term insurance plan can offer the following benefits:

Endowment plan is a combination of insurance and savings. It offers three benefits to the life assured under a single plan – long term savings, life insurance and tax benefits. This policy not only provides protection to the insured but also helps the policyholder save some money on a regular basis for future financial milestones. The traditional endowment plans promise a minimum value as on specified date as long as the premiums are paid as per schedule. It is one of the most disciplined methods of saving money for all your future financial needs.

Let us look at few key benefits of buying an endowment plan:

As the name suggests, this type of life insurance plan offers a specific amount/ percentage of the sum assured as money back to the life assured at pre-decided intervals. This money back benefit is usually called survival benefit.

In case, the insured dies during the policy term, then a death benefit will be payable to the nominee, without any deduction of past survival benefits already paid and the policy would be terminated.

Here are the benefits of a money back policy:

A whole life insurance plan offers life coverage as long as the insured lives. For ease of administration, insurance companies may define a maturity age which could be 80, 85 or even 100 years. Unlike a term plan, if the life assured lives throughout the policy term the maturity benefit is paid at maturity.

Benefits of whole life cover are as follows:

A child plan acts as a tool to provide funds during the important stages of a child's life, like higher education, marriage or start of professional life. A child plan helps one secure a corpus for their child so that finances do not come in the way of their child’s dream. Generally, child plans provide benefits as regular payouts at pre-decided intervals or a 1-time payout as defined at the start of the policy.

In an unfortunate event of the untimely demise of the insured parent during the policy term, most child plans will waive off the future premiums and the plan will continue till the opted policy term will all the benefits intact. Many insurance plans also pay an additional amount immediately upon death of insured parent to take care of any immediate financial burden.

The following are the benefits of child insurance plans:

Retirement plans are also known as pension plans. The plan helps the life assured accumulate a corpus for their retirement. Typically, retirement plans provide steady income, post retirement through an Annuity Policy purchased from the proceeds of a pension plan. With pension/retirement plans these days, here is what you get:

Here are the benefits of retirement plans:

A ULIP offers life cover plus wealth creation (market-linked returns). Here, the life assured pays premium, that gets invested into different funds opted after deduction of defined charges, including cost of insurance.

With a ULIP, the life assured can choose funds, depending on their risk appetite, that invest in equities, stocks, funds, and bonds. The funds offered are low, medium, high risk funds, balanced funds, cash funds, etc.

The benefits of ULIPs are as follows:

Here’s a comparison between different types of life insurance plans in India:

| Basis | Term Policies | Whole Life Insurance Policies | Endowment Plans | Unit Linked Insurance Plan | Money Back Plans | Pension/ Annuity Plan |

|---|---|---|---|---|---|---|

| Overview | Pure Protection - Simplest and cheapest Form | Whole Life with saving component | Protection + Saving with minimum guaranteed benefits | Protection + investment + Speculative returns | Protection+ Saving + periodic survival benefit + Maturity Benefit | Offers Annuity/ income till the person survives. |

| Death Benefits | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ (depends upon option chosen) |

| Maturity Benefit | X | ✓ | ✓ | ✓ | ✓ | X |

| Tax Benefits | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Rider Option | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Ideal For People who want | To protect financial support to the family if one dies. | To leave a legacy | Life coverage & returns with minimum risk | Looking for insurance along with willingness to take risk on investible premium. | Insurance + regular income flow | To secure regular income for pos retirement years. |

| Sr.no | Name of the Products | Line of Business (Individual / Group) | Product UIN | Product Page | Calculator |

|---|---|---|---|---|---|

| 1 | Future Generali Long Term Income Plan | Individual | 133N090V03 | View Product Details | View Calculator |

| 2 | Future Generali Saral Pension | Individual | 133N089V01 | View Product Details | View Calculator |

| 3 | Future Generali Money Back Super Plan | Individual | 133N088V02 | POS Variant / NON-POS Variant | View Calculator |

| 4 | Future Generali Saral Jeevan Bima | Individual | 133N087V01 | View Product Details | View Calculator |

| 5 | Future Generali Lifetime Partner Plan | Individual | 133N086V01 | View Product Details | View Calculator |

| 6 | Future Generali New Assured Wealth Plan | Individual | 133N085V02 | POS Variant / NON-POS Variant | View Calculator |

| 7 | Future Generali Assured Wealth Plan | Individual | 133N083V02 | View Product Details | View Calculator |

| 8 | Future Generali Express Term Life Plan | Individual | 133N082V03 | View Product Details | View Calculator |

| 9 | Future Generali Heart and Health Insurance Plan | Individual | 133N069V03 | View Product Details | View Calculator |

| 10 | Future Generali Term with Return of Premium | Individual | 133N068V02 | View Product Details | View Calculator |

| 11 | Future Generali Sampoorn Loan Suraksha (Group Product) | Group | 133N066V02 | View Product Details | |

| 12 | Future Generali New Assure Plus | Individual | 133N065V02 | View Product Details | View Calculator |

| 13 | Future Generali Big Income Multiplier | Individual | 133N064V03 | POS Variant / NON-POS Variant | POS Variant / NON-POS Variant |

| 14 | Future Generali Cancer Protect Plan | Individual | 133N063V03 | View Product Details | View Calculator |

| 15 | Future Generali Jan Suraksha Plus | Individual | 133N060V02 | View Product Details | View Calculator |

| 16 | Future Generali Jan Suraksha | Individual | 133N059V02 | View Product Details | View Calculator |

| 17 | Future Generali Flexi Online Term Plan | Individual | 133N058V04 | View Product Details | View Calculator |

| 18 | Future Generali Assured Education Plan | Individual | 133N057V02 | View Product Details | View Calculator |

| 19 | Future Generali Assured Money Back Plan | Individual | 133N056V03 | View Product Details | View Calculator |

| 20 | Future Generali Triple Anand Advantage | Individual | 133N055V02 | View Product Details | View Calculator |

| 21 | Future Generali Assured Income Plan | Individual | 133N054V04 | View Product Details | View Calculator |

| 22 | Future Generali Loan Suraksha (Group Product) | Group | 133N053V02 | View Product Details | |

| 23 | Future Generali Group Gratuity Plan | Group | 133N045V03 | View Product Details | |

| 24 | Future Generali Group Leave Encashment Plan | Group | 133N044V03 | View Product Details | |

| 25 | Future Generali Group Superannuation Plan | Group | 133N043V03 | View Product Details | |

| 26 | Future Generali Care Plus | Individual | 133N030V05 | View Product Details | View Calculator |

| 27 | Future Generali Immediate Annuity Plan | Individual | 133N006V02 | View Product Details | View Calculator |

| 28 | Future Generali Group Term Life Insurance Plan | Group | 133N003V04 | View Product Details | |

| 29 | Future Generali Big Dreams Plan | Individual | 133L081V02 | View Product Details | View Calculator |

| 30 | Future Generali Comprehensive Employee Benefits Plan | Group | 133L080V02 | View Product Details | |

| 31 | Future Generali Easy Invest Online Plan | Individual | 133L061V03 | View Product Details | View Calculator |

| 32 | Future Generali Dhan Vridhi | Individual | 133L050V03 | View Product Details | View Calculator |

| 33 | Future Generali Bima Advantage Plus | Individual | 133L049V03 | View Product Details | View Calculator |

| 34 | Future Generali Wealth Protect Plan | Individual | 133L036V03 | View Product Details | Gold / Platinum |

Here’s how life insurance policies work:

Death Benefit/Life Cover

In the case of the unfortunate event of the life assured's demise, the sum assured or the death benefit is paid to the nominee of the life assured and policy gets terminated.

Survival Benefit:

In the case of insurance plans like money back plans or income plans, survival benefit i.e., specific amount/ percentage of the sum assured is given back to the life assured at pre-decided intervals.

Maturity Benefit:

At the end of the policy term, if the life insured survives s/he is paid the promised maturity benefit.

Life insurance policies have the following key features:

Flexibility to pay premium(s):

The following are the benefits of having a life insurance policy:

What is the worth of your life? When shopping for life insurance, you need to answer this strange question. The primary purpose of life insurance is to provide financial security for your family if something unexpected happens to you. Hence, the life cover should be sufficient to settle any outstanding debts as well as provide a source of income for your (the life insured’s) family.

The following tables can help you calculate how much life insurance you need. The amount of insurance cover depends upon what will it take for your family to keep up their current lifestyle in your absence.

Each one of us aspires for a happy Life and works hard toward achieving the same. However, there are uncertainties around and as it is said, in case GOD has a different plan for you, that will prevail.

While one cannot avoid or keep uncertainties away, it is possible to reduce or minimize the implications or impact of uncertainties related to human life, which primarily could be Death, Disability or Disease. While nothing can compensate emotional losses, financial losses can be compensated to an extent using insurance policies. What you need to do is to plan well. What you buy should be keeping in mind the uncertainty you want to protect your loved ones from.

While one cannot avoid or keep uncertainties away, it is possible to reduce or minimize the implications or impact of uncertainties related to human life, which primarily could be Death, Disability or Disease. While nothing can compensate emotional losses, financial losses can be compensated to an extent using insurance policies. What you need to do is to plan well. What you buy should be keeping in mind the uncertainty you want to protect your loved ones from.

There is no substitute for pure protection insurance policies that pays upon death of insured or say a Mediclaim insurance policy that compensates the covered hospitalization expenses.

You can also look for a critical illness policy which provides you a fixed sum on specified critical illnesses to top up your Mediclaim policy for expenses over and above the hospitalization expenses

Apart from a term or a critical illness policy, Life Insurance policies can also come handy when it comes to securing long term savings for specific life goals, beyond pure risk cover. For example, a child will go to college at age 17 and for higher education at age 21 or 22. Life insurance plans can help you achieve such an objective without subjectivity. You can create a decent corpus that enables availability of funds for admission to a decent college and also to handle an undesirable scenario to meet the expenses even if the parent was not around.

Before you buy any insurance policy, it is important to define the objective for which you want to buy an insurance plan. If you are buying a term plan, try getting a total cover of at least 10 times your annual income so that in case of an eventuality, the amount available to your family is adequate to generate income for them to survive without any compromise in the lifestyle for next 12 to 15 years. You should ideally look at a term plan that covers you up to age 60/65, i.e. matching your retirement age. The longer the duration of term plan, costlier it gets.

If you are buying a savings plan, make sure the policy term meets the target date of your financial goal for which you are buying the plan.

Insurance saving plans can be fully guaranteed or fully non-guaranteed or combination of two. You need to choose an appropriate plan that best fits your need. For example, you need a lump sum for your daughter’s marriage or a sum at disposal when you retire, you need a product that pays a lump sum whereas if you are looking for a regular income post retirement, you may evaluate income plans.

The product type depends upon your risk appetite.

The benefit Illustration is the most important document to understand the product and its benefits Just remember the following mantra:

Data as on 31 st March 2024

Premiums are payments that are made in order to receive life insurance benefits. A premium is paid yearly, but a half-yearly, quarterly, or monthly payment option is also available. Premiums also contribute to the growth of the policy's cash value.

The premiums paid to the insurance company by the life assured are determined by the insurance company. However, both the policy term (duration of the policy) and sum assured are chosen by the buyer.

When calculating the Premium, the insurance company takes various factors into account, including your lifestyle, occupation, number of dependents, finances, sum assured, etc.

With increasing awareness around insurance, we can find people who look for buying an insurance policy or look at few options before taking the final decision on a recommendation. One of the questions that often gets asked is about why the price for similar offering will be different across different life insurers. Most of the times, you may also find two similar life insurance products in the same company also having different premium. Let’s understand this in simple language.

First, we need to understand are we comparing like to like. Key factors for this include:

Factors that will influence premium for every policy are:

The premium payable under an insurance policy is the consideration towards the cover or benefits that insurance company promises to the policyholder upon happening of certain event or at specified time.

The first and most important influencer is the policy type or the benefits payable under a policy.

A pure term policy will be the cheapest form of insurance since a claim is payable only upon death, followed by term with return of premium where along with life cover, premiums are returned if the insured person outlives the policy period. The savings plans will call for a higher premium compared to both term and term with return of premium since it intends to pay more than the total premiums paid on survival and/or on maturity.

The premium in a life insurance savings plan will depend upon the benefits, which may be fully or partly guaranteed under the policy, the cost of insurance as well as the amount of cover (Sum Assured) and the risk associated with the investment under the policy.

The benefit Illustration is the most important document to understand your policy and its benefits vis a vis the premiums to be paid. It shows a comparison of what you pay and what you can get.

While all this holds true, there is an important angle to insurance saving plans – while your premiums may vary a little, the protection that it provides to your life moments is priceless.

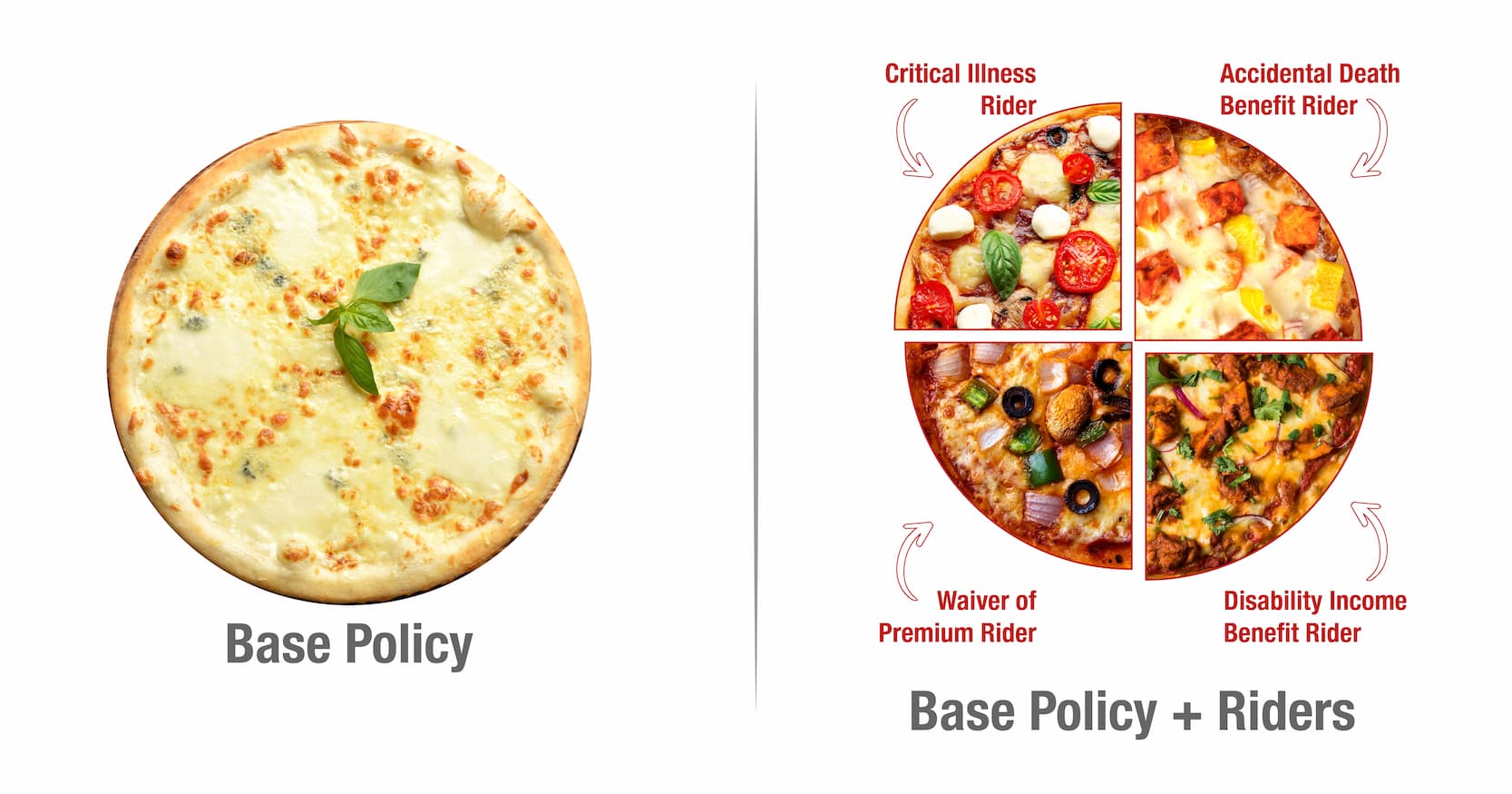

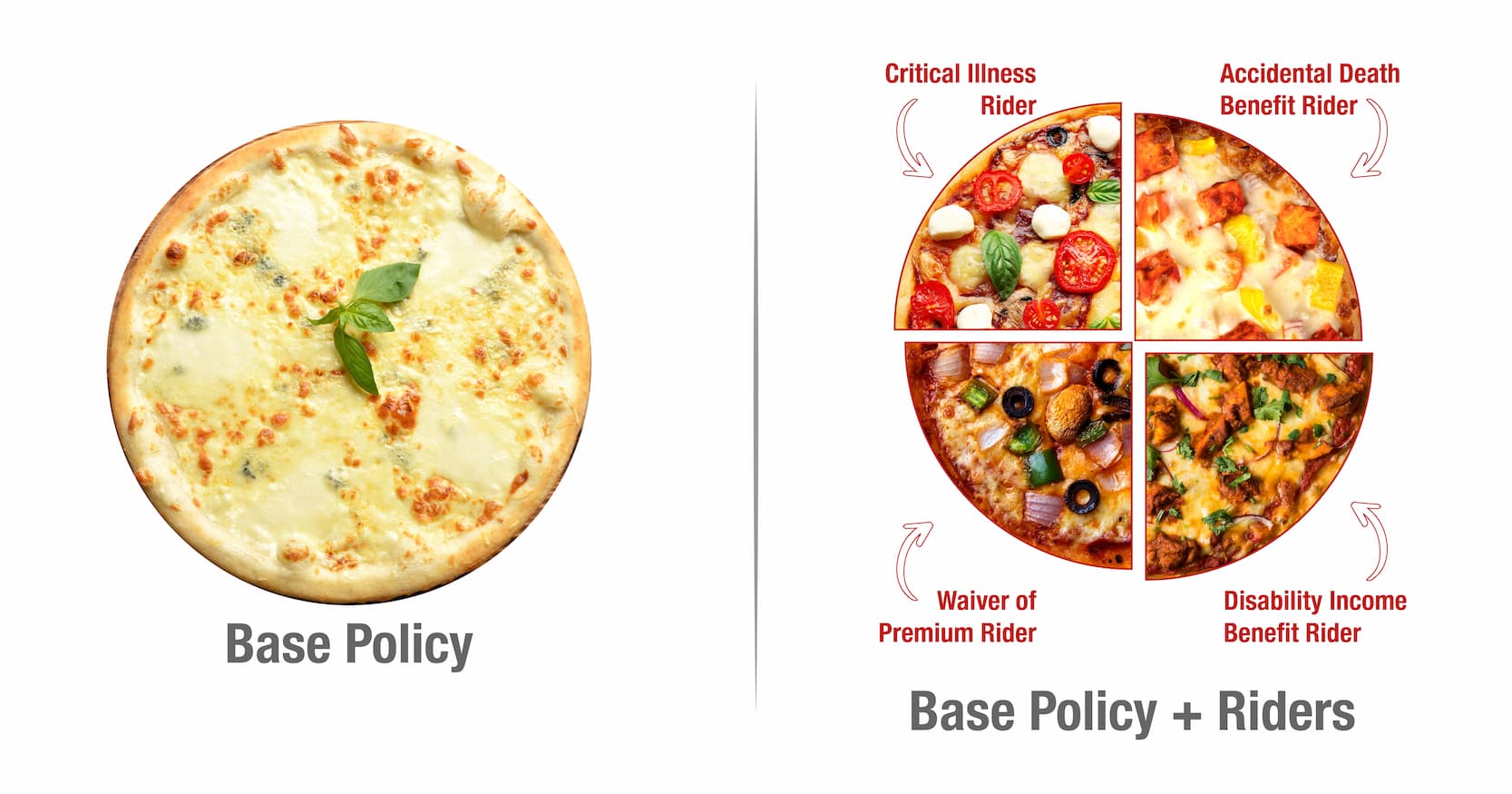

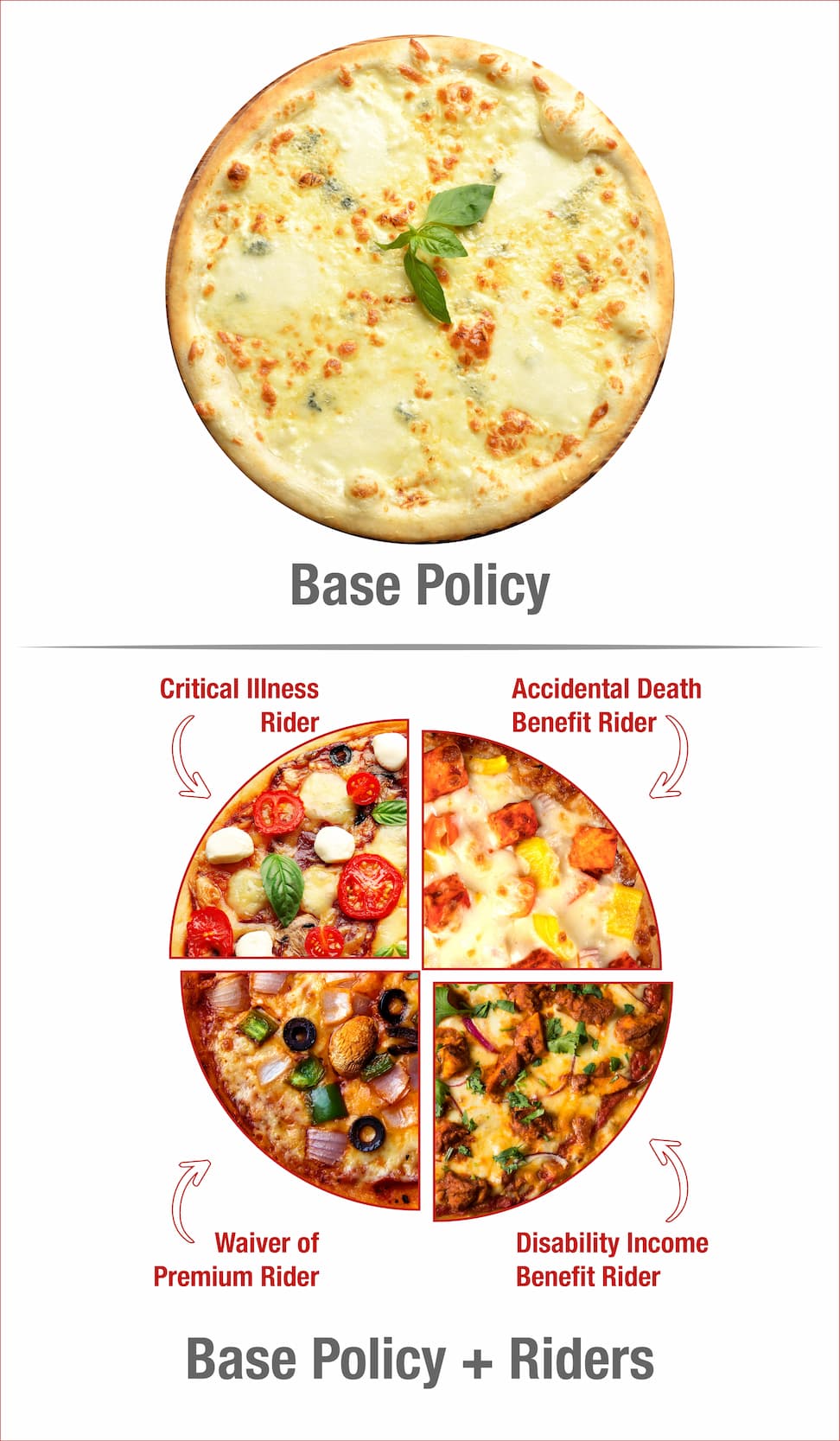

Insurance companies offer riders i.e., optional add-on coverage to enhance the coverage provided by the base policy. One must know about the suitable riders before opting for the same.

Here are some of the rider options available in various insurance policies:

1. Accidental Death Rider

Accidents are a leading cause of death around the world, so it makes sense to avail of the accidental death rider. In the event of your untimely death due to an accident, this rider will pay additional benefits to your beneficiaries over and above the policy's death benefit. A family's finances can be severely impacted by the death of the primary earning member, so for these individuals the accidental death benefit rider is a must.

2. Critical Illness Rider

Cause of critical illness can be hereditary or the lifestyle that we lead. And in worst case, one instance of critical illness may completely wipe out a person's savings. Life insurance policies with a critical illness rider can come handy in case such an adverse situation strikes. When life insured is diagnosed with a serious health condition covered under the critical illness rider, it pays a lump sum benefit. The money you receive from the payout can be used to pay your hospital bills and maintain your lifestyle or to meet recuperation expenses. Make sure you are aware of the types of illnesses covered under this rider, as they tend to vary from one insurance provider to another. The payment of critical illness can be standalone i.e. over and above the other policy benefits or accelerated i.e. can terminate the policy upon payment of full benefit. It is important to note that a waiting period and survival period may be applied to the riders covering illness.

Waiting period means the time period after which you are eligible for a claim.

Survival period means the minimum time period that life assured needs to survive (after diagnosis of critical illness) to be eligible for a claim.

3. Waiver of Premium

Premium payment for a policy may be interrupted in case the earning member dies or contracts a critical illness or becomes disabled. In such a situation, a waiver of premium rider helps keep your policy active. The policy continues with all benefits without paying future premiums (future premiums are waived) in such cases. It is important to note that a waiting period may be applied to the riders covering illness.

4. Terminal Illness Rider

Watching a loved one suffer from a terminal illness drains not only your emotions but also your finances. A family's savings can be wiped out if it needs to seek treatment at any of the country's top hospitals. If you want to avoid this, getting a Terminal Illness Benefit/Rider may be a good idea. When the life insured is diagnosed with an illness that can lead to his/her demise within a defined period (as mentioned in the policy document), it pays out cash advances against the death benefit. The potion of death benefit paid can be used to pay for the costs of treating a chronic condition or terminal illness.

5. Disability Rider

The disability rider pays an additional sum upon total and/or permanent disability of the life insured because of an illness or accident or both. Some disability riders also cover partial disability.

If you plan to add riders to your policy, you should study them thoroughly including their benefits, inclusions and exclusions. It is important to note, however, that although the above-mentioned riders can enhance the value of your insurance policy, you should read through your policy brochure first to check what all riders are allowed. Look at your current plan's coverage and choose a rider that would meet your needs if the level of protection is inadequate.

In order to apply for a policy, you will have to submit the following documents:

The Insurance Company may call for additional information or documents depending upon the amount of cover applied, the premium that you will be paying and your profile, including but not limited to your lifestyle, habits, family history etc.

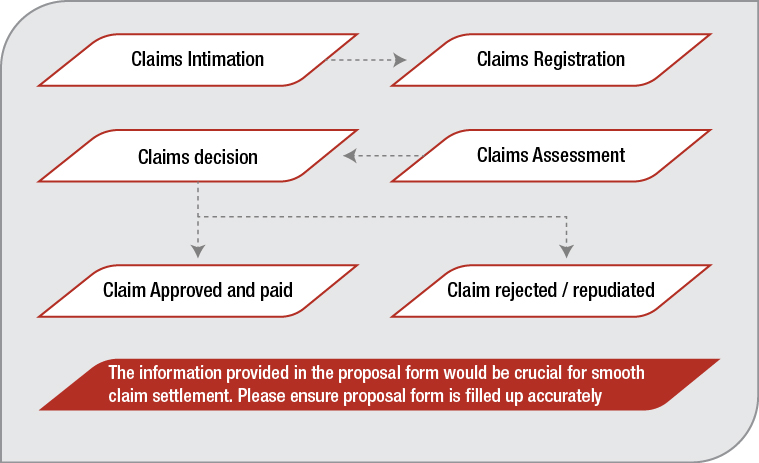

An insurance claim is a formal request by a policyholder/nominee. This is made to the insurance company for compensation against the insured event.

Typical claim process is as follows:

Insurance companies publish the claim process on their website and it is also mentioned in your insurance policy document. If all the necessary steps are taken care of, filing a claim and collecting the assured amount can be a piece of cake. You must file the claim in the right way.

If you are not satisfied with the claim process, you have three levels to raise your concern:

It is important to understand that term insurance is a type of life insurance. Life insurance as a whole provides either death benefit or both death and maturity benefit. Whereas, a term insurance plan provides only death benefit in the case of unfortunate demise of the life insured within the policy term.

2. Can the premium amount change during the policy term?Usually, life insurance premiums do not change after the policy has been issued, unless there has been a change in the terms and conditions like increase in sum assured, if allowed under the policy, addition/deletion of any additional benefit like rider, etc. or because of adverse health condition at the time of revival/ reinstatement of a lapsed policy.

3. How long will I have to pay premiums?The life assured is required to pay premiums for the tenure selected by him/her while purchasing the policy. The life assured can also choose the frequency of pay premium like annually, half-yearly, quarterly, or monthly depending on the one’s convenience.

4. How do I select the policy term?Policy term should ideally match the earning years if you are buying a term plan and the target financial milestone if you are buying a saving/investment plan. For example, if you are buying a child plan, the policy term should match the appropriate age/milestone of your child for which you are buying the policy, and if you are planning for retirement, the policy term should match your retirement age.

5. What happens if I can’t pay the premiums?If you stop paying premiums, the insurance policy will lapse or become paid-up after the grace period is complete. The benefits payable under the policy will cease if the policy lapses and reduce if the policy becomes paid-up, depending upon policy terms and conditions.

6. Is a life insurance policy required if I already have one provided by my employer?The insurance cover provided by your employer will be in existence only till the time you work for the employer. Hence, it is always suggested to buy a personal life insurance policy. Further, you may need to check the amount of cover offered in the employer-provided life insurance policy. If the cover provided is adequate, you may decide not to buy a separate policy.

7. What is the cost of life insurance per month?The cost of a life insurance policy depends on a number of factors. These factors include the type of life insurance policy you choose, the amount of coverage you want, your age, health, gender, occupation, and the results of any pre-issuance medical tests (if any) etc..

8. Is a term life insurance cover of Rs 1 Crore enough?The thumb rule for calculating your insurance amount is to get 10 times your annual income. Your annual income will determine whether Rs. 1 crore is enough coverage for you or not.

9. What is the best age to get a life insurance policy?To ensure a financially secured future over an extended period of time and at a lower premium rate, it is wise to buy it at a young age. The premium of the policy increases with age. Thus, the best time to buy an insurance policy is when you are young.

10. What is the right amount of life insurance coverage?As a rule of thumb, one should choose a life insurance policy at least ten times his or her annual income. The life insurance you choose now may not be sufficient to provide your family with the financial security it needs in the future due to inflation leading to the rise in cost of living. You should therefore consider these aspects before choosing the life insurance coverage amount.

11. Is it a waste of money to buy life insurance?Buying insurance is a safety measure designed to provide the family with much-needed financial stability and security in the event of some unforeseen situations.

12. What happens to the policy if the life assured survives till the end of the policy term?It depends upon the type of life insurance policy you hold. No maturity benefit is payable under a pure term plan. However, if the policy is other than pure term plan, the life assured may receive a maturity benefit as per the policy terms and conditions.

13. Are the premiums paid towards life insurance policy eligible for tax benefits?You may be eligible for tax benefits of up to Rs 1,50,000 on the premium(s) you pay subject to the provisions under Section 80C of the Income Tax Act 1961, as amended from time to time. These benefits are subject to change as per the prevailing tax laws. Please consult your tax advisor for more details.

14. How many life insurance policies can a person have?There is no limitation on the number of policies one can own. Although most insurance companies are less concerned about the number of policies one can own, they may pay close attention to the amount of premium you pay and the amount of insurance cover offered on your life not being disproportionate to your income. The proposer needs to disclose his other policy details at the time of filling the proposal form.

15. What is the maximum age to buy a life insurance plan?There is no age limit by law for buying a life insurance policy. It depends upon the product specific limitations applied by the Insurance Company offering a policy.

16. What is assignment in insurance?A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment.

An “assignor” (policyholder) is the person who assigns the insurance policy. An “assignee” is the person to whom the policy rights have been transferred, i.e. the person to whom the policy has been assigned.

In the event rights are transferred from an Assignor to an Assignee, the rights of the policyholder are canceled, and the Assignee becomes the owner of the insurance policy.

People often assign their life insurance policies to banks. A bank becomes the policy owner in this case, while the original policyholder continues to be the life assured whose death may be claimed by either the bank or the policy owner.

Suggested Read: What is assignment and nomination in insurance?

In the event of the death of the life assured, the nominee is able to appoint a beneficiary (usually a close family member) to receive the benefits. Nominees are those individuals appointed by policyholders to receive benefits. The nomination process is governed by Section 39 of the Insurance Act, 1938.

Suggested Read : What is assignment and nomination in insurance?

After the death of the life assured, his/her nominee or the legal heir can file a claim for the life insurance policy.

19. Can insurance be cashed in before death OR can I withdraw money from my Life Insurance Policy?Yes. It is possible to cash in or surrender a policy based on its cash value/surrender value. Life insurance policy will terminate upon payment of surrender value. You can avail loan facility instead, if permitted in your policy, if your need of funds is temporary.

20. Is life insurance benefit paid if the life assured commits suicide?Death benefit will not be paid to the nominee if the life assured commits suicide within 12 months of purchasing a policy or revival/reinstatement of a lapsed/paid-up policy. Typically, 80% of Premium amounts paid by the life insured are paid to the nominee by the insurance company in such cases. If the death happens because of suicide after 12 months, full death benefit as per policy terms and conditions is payable.

21. What is the paid up value of a life insurance policy?If the premiums are not paid after 2 years of premiums have been paid in a traditional insurance policy, the policy does not lapse but becomes a paid-up policy with reduced benefits.

22. What is the meaning of surrender value?If the life insured voluntarily terminates the policy before its maturity, the insurance company will pay the surrender value to the policyholder, if applicable under the policy.

23. Is it necessary to have both life cover and critical illness insurance?It is advisable to have both life cover and critical illness cover. Life insurance will protect the financial wellbeing of your family in case of your death whereas a critical illness cover will ensure your savings are not used up for treatment of a critical illness.

24. What are the dos and don’ts of life insurance?Here are some do's and don'ts to follow when buying life insurance:

Dos:

Don'ts:

It is recommended to pay the premiums to ensure you enjoy all benefits in an insurance policy. In case of non-payment of due premiums, the policy can become Lapsed or Paid-up. A Lapsed policy typically will not have any value and will terminate if you do not revive it. A Paid-up Policy will typically offer reduced benefits in case you discontinue premium payments. The status depends upon the minimum number of premiums required as per your policy terms and conditions.

26. What are the steps to revive a lapsed policy or paid-up policy?To continue receiving the benefits of your policy, you need to renew it on time. Your policy will lapse or become paid-up if you fail to renew it. If this is the case, you will have to pay the due premiums. You may be charged a late fee or interest or both for the lapsed period. You may also be required to undergo a medical examination.

27. What is the difference between life insurance and general insurance?Life Insurance policy will cover human life. For everything else, there is General Insurance. It is important to note that General Insurance companies do offer specific covers on human life e.g. medical insurance (Mediclaim), personal accident and critical illness covers.

28. Is death benefit paid to the nominee if the life assured dies in a foreign country?Yes, the death benefit will be paid to the nominee irrespective of where the Life Assured dies.

29. Is there a maximum amount of life insurance coverage I can buy?Each life insurance plan has a set sum assured limit by the insurance company. Moreover, the individuals age, income, occupation, health status, and many other factors help in determining the maximum coverage s/he can avail.

30. What happens if the life assured does not add a nominee?In case a policyholder does not nominate any nominee, the payout will either go to their legal heirs or the estate, subject to submission of documents required as per prevalent laws. In order to ensure a fast and hassle-free settlement of claim, it is always advisable to register a nominee.

31. What if the nominee dies before the life assured?The life assured can appoint a new nominee if the nominee dies before him/her.

32. What is the need for life insurance for retirement?A type of life insurance plan, known as pension plan or retirement plan can help the life assured secure his/her financial future after retiring. It works to accumulate corpus that can generate a regular income after your retirement so that you can enjoy your golden years worry-free!

33. Is the policy benefit paid only in a lump sum?The payout pattern will depend upon the policy that you buy.

34. How to make the claim intimation at Future Generali India Life Insurance Company Limited?You can make a claim intimation at Future Generali India Life Insurance Company Limited through any of the following modes:

The TAT for claim settlement is as follows:

If the claim is not processed within the given TAT:

If there is a grievance in the claim settlement the following steps must be taken:

Section 45 of the Insurance Act 1938 as amended from time to time, states:

Future Group's and Generali Group's liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited. Future Generali India Life Insurance Company Limited (IRDAI Regn. No.: 133) (CIN:U66010MH2006PLC165288). Regd. Office & Corporate Office address: Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400083 | Fax: 022-40976600 | Email: care@futuregenerali.in | Call us at 1800 102 2355 | Website: life.futuregenerali.in

ARN No.: ADVT/Comp/2022-23/April/509